Yield farming is one of the most popular methods for investing in Defi. It benefits both consumers who receive rewards and defi platforms that keep their liquidity. Nowadays, many peoples are interested in defi yield farming platforms. This article will give you some information on how to build a successful yield farming development and it can help decide to set up protocols.

Let’s get more information about it…

Brief And Simple Introduction About Defi Yield Farming:

Yield farming is a defi best investment strategy that enables people to make crypto from more crypto. With the help of automated smart contracts, you can lend your funds to others and receive your fees in the form of crypto in return. It looks simple but in reality, yield farming constantly moves money across lending marketplaces using sophisticated tactics in order to maximize their profits.

Let’s explore the defi yield farming world in more detail to learn how it functions, what kinds of yields farmers can anticipate, and much more about it.

What’s The Procedure Of Working Yield Farming?

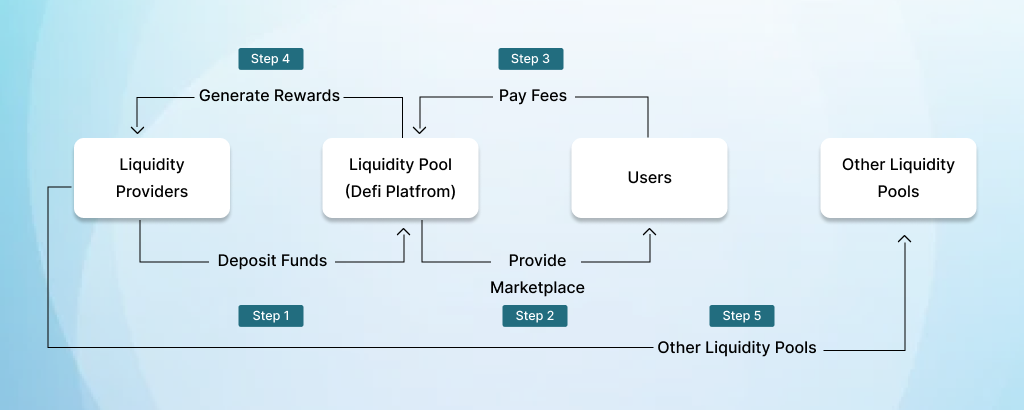

Yield farming is majorly involved in the role of liquidity pools and liquidity providers. A user is referred to as a liquidity provider if they deposit cryptocurrency into a smart contract. The Automated Market-Maker exchanges, which are specialized decentralized exchanges, host these pools (AMM).

The defi yield farming token process is described in detail here…

Step 1:

Liquidity pools, which are effectively smart contracts, are where liquidity providers deposit their money. This money is restricted by smart contracts and becomes accessible under their restrictions and on platforms for it.

Step 2:

In the second step, the liquidity bridge helps users to exchange funds. Also regulates the market for borrowing and lending. Also, users using the defi platform pay a fee. That way liquidity providers can leverage earnings.

Step 3:

When liquidity providers lock up their funds in a pool, they are compensated with a fee. Generated in tokens based on the amount invested and the protocol of the platform.

Step 4:

Tokens are deposited into a liquidity pool. Liquidity providers reinvest tokens in other liquidity pools to get higher yields. So can increase the chance of making complex investments. The application of appropriate strategies will ensure that maximum benefits can be derived from crop cultivation.

Top 5 Defi Yield Farming Platform To Invest In New Era:

- PancakeSwap

- Uniswap

- Curve Finance

- Aave

- SushiSwap

How Should DeFi Yield Farming Returns Be Calculated?

When asked to calculate returns for liquidity providers, the following metrics play a crucial role.

- Total Value Locked (TVL):

A parametric number known as TVL is used to assess the amount of cryptocurrency locked in deFi lending and other marketplaces. A thorough picture of their performance may be obtained by tracking the entire value of the cryptocurrencies locked in the smart contracts of various platforms. A useful method for combining liquidity in liquidity pools is TVL.

- Annual Percentage Yield (APY):

It stands for the annual rate of return imposed on borrowers and later paid to providers.

- Annual Percentage Rate (APR):

The annual rate of return that is imposed on capital borrowers but paid to capital providers is represented by this.

What Are The Benefits Of It?

Defi yield farming has a number of advantages. Several of them are listed below.

- Easy User Interface:

Investors use various apps to track their investments. Hence, they get an opportunity to learn the cultivation of this crop with practical help. The apps are built with a user-friendly interface to help users check the availability of projects.

- Easy Start:

Due to the high interoperability of the DeFi platform, users can quickly start farming yields.

- Profit Potential:

Participants who earlier staked their cryptocurrency into protocols can profit from their investments.

- Interoperability:

The defi sector is highly adaptable and interoperable. While some defi platforms stake the crypto and automatically move it from platform to platform to impart better investment outcomes.

Is Yield farming really worth it?

It is dependent on your specific goals and needs whenever you decide to invest in cryptocurrencies. We should know the advantages, disadvantages, potential profits, and potential losses in order to actually obtain a thorough understanding of whether it is worthwhile or not.

Moreover, If you want to be curious about defi yield farming, or are you interested to develop it. So, you should know all the basic and advanced information. Also, this advanced technology should be developed with the help of defi yield farming development company. Which can really be worth it for your business. It benefits both consumers who receive rewards and defi platforms that keep their liquidity.

Bottom Line: Should Defi Yield Farming Start Investing Today?

This will have a big impact on what you are looking for in a Bitcoin investment.

Yield farming is a high-risk, high-reward strategy that potentially leads to high returns, but remember that there are also risks such as temporary losses due to the high volatility of the cryptocurrency market. For the development of produce farming, you need to find the best development company. This development company helps in developing the service at a low cost with the help of its expert developers. Which helps in earning in your farming.

Our company provides more expert developers to develop and maintain it on a regular basis. Contact us directly or through social media, if you are interested in developing yield farming tokens – Rain Infotech Private Limited.